Budget 2025: Politically good, fiscally underwhelming

A peek into the minds of our policy makers.

Well, the Budget Session of the Parliament started out on a strong note! The budget hit all the right notes politically and the cherry on the topping was that there wouldn’t be any income tax on incomes below Rs. 12 lakh.12 As usual, the Economic Survey of India was released a day prior to the budget. The Economic Survey outlines the current state of the economy and the country’s policy directions. Read together with the Budget, there are some interesting insights that can be gleaned.

The one theme that I am taking away from this year’s Economic Survey and the Budget is that deregulation seems to Word of The Year. I have consistently advocated for laws that are low on regulation and that get out of the way. I covered this in my series on Agriculture and my post on Labor laws.

Thankfully, the Economic Survey recognizes this and has a section on how deregulation is essential to growth. The Budget also recognizes this and has promised to implement Jan Vishwas 2.034. The Economic Survey lays out the specific policy sections that each state needs to look at. As part of incentivizing states to reform their laws, it would be introducing another Ease of Doing Business Index to promote competitive federalism. It is heartening to hear policy makers focus on the nitty gritty of laws rather than go for big bang reforms. I took a chart from the Economic Survey that illustrates this point well. States ranked higher in the ease of doing business have higher Gross Value Added (GVA)5.

In the global economy, India seems to be the only bright spot. France, Germany, Britain and other European economies are struggling. Chinese overcapacity in manufacturing threatens to forcibly deindustrialize other countries’ industries. With the US Federal Reserve keeping rates high, the USD is strengthening causing other currencies to weaken in comparison. The Rupee is holding up well compared to other Asian currencies.

On the whole, I am positive about the budget6. It hits all the right notes, recognizes the risks to the economy in the current geopolitical climate and is a political masterclass. The cherry on the cake is that fiscal deficit is going to be 4.4% of GDP. The government has managed the fiscal space deftly.

I lay out my thoughts on the budget and the Economic Survey in no specific order.

The Big Income Tax Relief

There’s no Income Tax for up to 12 lakhs of income. Looks like Nirmala Sitharaman listened to the constant asks for tax relief and delivered. What would the fiscal impact? There are about 9-10 million tax filers7 in the 7L - 12L range. Assuming that the average return is about Rs. 30,000, the fiscal impact ends up being around Rs 25,000 crore - Rs30,000 crore.8 The timing of this relief is highly strategic. Raising the exemption limit to ₹12 lakh is a bold move that will temporarily silence demands for further tax breaks. But as inflation gradually erodes its real value, the government could conveniently hike it again in 3-4 years—just in time for the next general elections—to win even more political goodwill.

It seems the tax cut will have a one-time secondary impact on GDP growth and we may see GDP grow more than 8% next year. There are fears that the tax cut might fuel inflation, but I think it’s unlikely. Rural consumption has been robust, it is urban consumption that has been weakening. The tax cut will primarily be to urban folks, so even if inflation rises, it shouldn’t be too much.

What do the economists in the PMO think about inflation?

With inflation easing up in the US and other advanced economies, inflation should start to subside in India as well. That gives more fiscal space for capex on larger projects. This naturally leads to an expectation that interest rates - set by Central Banks - would ease up, but that’s uncertain. There are other factors to inflation though. Due to disturbances in the Middle East, trade in the Suez Canal is being disrupted. Trump’s election has almost certainly rung the death knell for globalization. World trade is likely to decline and the impacts on inflation are hard to predict.

Domestic inflation is going down. Food inflation is being driven by very few food items. Mainly by tomato, onion and potato. The primary cause of these is extreme weather conditions. With climate conditions becoming more unpredictable, I think it makes sense to have a policy favouring Genetic Engineering (GE) of crops. GE can be used to design hardy, high yielding varieties of seeds.

Domestic Economy

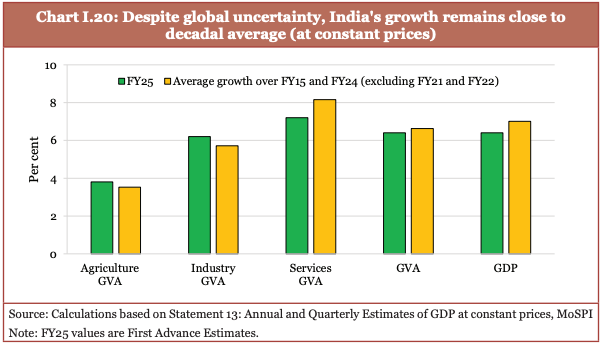

Despite geopolitical headwinds, India’s domestic economic remains steady. India’s growth is close to the decadal average in all sectors, agriculture, industry and services.

Growth in rural demand is strong, but urban demand needs to pick up. The crucial indicator here is passenger vehicle sales. This year, for April - November 2024, growth was 4.2% compared to 9.2% in the same April - November period of the pervious year. It is indicative of softening demand and could be another reason why the government decided to reduce personal taxes9.

On the labour front, the good news is that the Labour Force Participation Rate10 (LFPR) is going up while the Unemployment Rate (UR) is going down. So the unemployment rate is declining while more people are joining the economy. The other good news is that this is on the back of more formalization in the economy, as evidenced by the increasing number of EPFO accounts being created. EPFO accounts have doubled from 61 lakh in 2019 to 131 lakh in 2024. The chart below shows the UR decreasing from highs of 6% to half of that today. The quality of jobs leaves much to be desired though.

The urban-rural gap in consumption is coming down. Along with that, the Gini coefficient for rural and urban areas is declining too. The implication is that the inequality in the country is decreasing. This pretty much shuts down the Oxfam report's claim that inequality in the country has surpassed colonial-era levels.

Deregulation

The Budget announced Jan Vishwas 2.0 on similar lines as Jan Vishwas 1.0. There are thousands of provisions for jail in our laws regarding employers. Jan Vishwas 1.0 got rid of a few hundred. I hope Jan Vishwas 2.0 is more comprehensive and gets rid of even more provisions. Unfortunately, the way it looks, that is unlikely to happen. Distrust of employers is baked into societal DNA and changing that will take time.

Nirmala Sitharaman announced the creation of an Ease of Doing Business Index for states in the spirit of competitive federalism. The government correctly recognizes the need for deregulation driving growth, but there seems to be no other concrete plan in place. For the states, the Union government has suggested the following areas to look into.

Infrastructure

The Union government is spending tremendously on Capital Expenditure, spending money to create hard assets like ports, highways, railways, airports and more. The chart below shows actual capital expenditure in this financial year.

The government has allocated Rs. 11.12 lakh crore for infrastructure capital expenditure (CapEx), which is an increase of 10% over the last year. The crucial question is, do various ministries have the capacity to absorb such CapEx? As shown in the chart above, some ministries are far behind their capex targets with only 4 months left in the financial year. Housing and Urban Affairs has barely spent 50% of their CapEx. There’s no point in increasing the headline number if the capacity to absorb it isn’t present. We do not want highways to nowhere.

Another concern is that disinvestment or privatization is conspicuous by its absence. The Modi government had set targets every year for privatization of PSUs, but this year there haven’t been any announcements. Unfortunately, the opposite is happening. BSNL is getting an infusion of Rs. 83,000 crore. This is disappointing. There are plans to infuse about Rs. 13,000 crore into various government PSUs. The amount is easily affordable, but the direction isn’t.

As I have said many times before, government has no business being in business. Disinvestment gives an opportunity for the PSUs to be exposed to the market, improving performance. It absolves a huge financial burden from the government, and the one time windfall from divestments can be put to much better use.

Rural infrastructure development is progressing at a breakneck pace. I took the chart below from the Economic Survey of India 2024-2025 and it details all the initiatives that are in progress. CapEx is being put to good use here.

Capital Outlays and Schemes

This is the most hyped-up part of the Budget in the news, so I’ll just highlight what catches my interest.

Defence capital outlay11 has increased to Rs 1.8 lakh crore from Rs 1.7 lakh crore this year. This is a minuscule percent of our GDP and needs to be much higher. We live in an unsafe neighborhood and indigenization of defence needs to be a priority.

The Ministry of Jal Shakti has been given an additional Rs 99,503 crore, and its been extended till 2028. Why is this so? Is it because the government couldn’t spend the money efficiently or because it realized that it needed more money than it initially anticipated? This reduces the fiscal space for more schemes.

National Manuscript Mission (NMM) had its budget hiked from Rs 3 crore to Rs 60 crore. The government would also set up National Digital Repository for Indian Knowledge Systems. The Bharatiya Bhasha Pustak Scheme will provide books in Indian languages for school and higher education. All of these initiatives are essential for decolonization and I am happy that the government has recognized its importance. Providing books in Indian language is important to keep the languages alive and relevant to current times. Culture is embedded in languages and losing languages often means losing the cultures associated with it.

Housing and Urban Development has been given Rs 96,000 crore which is an increase from Rs 63,000 crore. As I mentioned above, the ministry hasn’t been able to spend even half its allocation, will it be able to spend the increased CapEx? I am optimistic that this goes into the cities, but only time will tell.

An Urban Challenge Fund of Rs 1 lakh crore will be set up to implement development projects in cities. This amount is far too low for all the cities in India, but with tax cuts and other schemes in the play, the fiscal space was probably limited. A good initiative!

There is Rs. 7000 crore allocated to semiconductor projects. Pranay Kotasthane has done an excellent summary of the spending on X (formerly Twitter).

Sitharam proposed a Nuclear Energy Mission with an outlay of Rs 20,000 crore. This is wrong spending. Nuclear can be a small part of the energy mix, but I agree with Noahpinion where he says that Nuclear is the past and Solar is changing our world right now. Solar needs to be the priority.

On the whole, as I said the budget hits the right notes politically, but it leaves me wanting in more deregulation and disinvestment. The government clearly recognizes the way to growth lays through deregulation12. Divesting from PSUs gives the government more fiscal room to play with allowing more social welfare.

I don’t want to sound like a broken record, so I’ll leave it at that, but if we want 10%+ real13 growth, deregulation and disinvestment need to jump up in priority.

The provinces will also have to participate in deregulation, because a lot of subjects that have criminal provisions for employers also come under state jurisdiction. Competitive federalism needs to be taken in the right spirit for development and to reach Advanced Economy (AE) status.

Adding the Rs. 75,000 standard deduction, this means that income up to Rs 12.75 lakh wouldn’t be taxed. There is some nuance here though. Due to the way Income Tax is calculated, someone earning 12.75 lakh won’t be taxed, but someone earning one rupee above the threshold would be taxed about Rs 60,000 or so. So this is a tax cliff, that would affect a minuscule percentage of filers.

Personally, I find other priorities of the Budget more interesting because they give you a sneak peek into policy makers’ minds. But tax slabs are the main attraction for the majority.

Jan Vishwas 1.0 decriminalized and rationalized certain offences. Do you really need criminal penalties for civil violations? Suppose an employer forces an employee to work overtime and violates a law in the process. Is that a crime worthy of imprisonment or a financial penalty? Penalty must be proportionate to the crime otherwise it just gives bureaucrats another reason to ask for bribes.

Bred into our social and policy psyche, is the mistrust of employers and the harsh criminal penalties for minor infractions reflects that. Until businessmen are seen as growth engines and drivers of economy, India cannot grow.

Gross Value Added is essentially how many goods and services are being produced in the state. It is different from GDP because taxes and subsidies are not considered while computing the GVA.

I have a CPI-O-Meter for India’s direction. Anything the CPI is bad for India turns out to be good. In this case, like clockwork, Brinda Karat has turned up to criticize the budget.

The data is taken from page 30 of this document. Thanks to X (formerly Twitter) user, SaiArav for pointing me to the document. Most of this analysis was lifted from his tweet.

What is the political game here? The Centre devolves about 40% of its tax revenues to the states. So about 40% of the loss in revenue is borne by the States, but 100% of the political credit goes to the Centre.

It is possible that at least some of the tax receipts lost by the government will come back to it as people consume goods and services and pay consumption taxes on it.

The ratio of people in the workforce to the total working population.

Capital outlay is the cost of acquiring capital assets like equipment, land or infrastructure. It is also known as Capital Expenditure. Capital Expenditure is the most desired type of expenditure because once created, it keeps reaping dividends for a long time. The most obvious ones are of course highways, ports and airports. But even things like investing in health, or digital infrastructure like the India Stack reaps dividends multiple times its cost.

There is no two ways about this. Argentinian President Javier Milei made deregulation his election plank. Elon Musk is heading DOGE in the US. There needs to be deregulation for growth. Businesses drive growth and if businesses continue being hobbled, they tend to leave the country for greener pastures.

As in, growth after considering inflation.